How I build passive wealth with cryptocurrency!

Most people are aware of the ability to earn passive income through the stock market or with real estate, but did you know there are multiple ways to earn passive income with cryptocurrency? Cryptocurrency has taken the world by storm and there are millions of people who believe in the underlying technology, including myself. I have been using cryptocurrency to earn passive income for a few years, and in this episode, I will discuss how you can do it too! The widespread adoption of cryptocurrency has created so many opportunities to profit with passive income, so let’s go over them!

Interest Earning Crypto Accounts

This is perhaps the simplest method to earn passive income with crypto. Think of this method as receiving coins on an interest-earning “crypto bank account.” Similar to the model of a traditional bank, you deposit your cryptocurrency with a cryptocurrency financial institution or exchange platform, and in exchange for allowing them to hold your coins to lend out, you receive interest in return. There are many companies who offer this service, among the most popular are Coinbase, Celsius, Blockfi, Gemini and Voyager.

Earning Interest from Lending

With this method, you lend out your cryptocurrency and allow someone to borrow your coins for a specified period of time in, exchange for an interest payment. There are four ways to lend crypto, and they are peer-to-peer lending, centralized lending, decentralized lending, or margin lending. Decentralized lending, or known as DeFi to most, allows users to lend cryptocurrencies directly on an exchange. In contract, peer-to-peer lending, centralized lending and margin lending are done through intermediaries, where you lend your crypto to an exchange, and the exchange lends the cryptocurrency to a borrower. If you plan on holding your coins for the long-term, then this method may be for you. It’s fairly simple to use a lending platform, first you register and then you transfer any crypto that you want to lend into your account. From there, you choose which coin you want to lend, and you can begin earning interest on your crypto instantly.

Crypto Staking

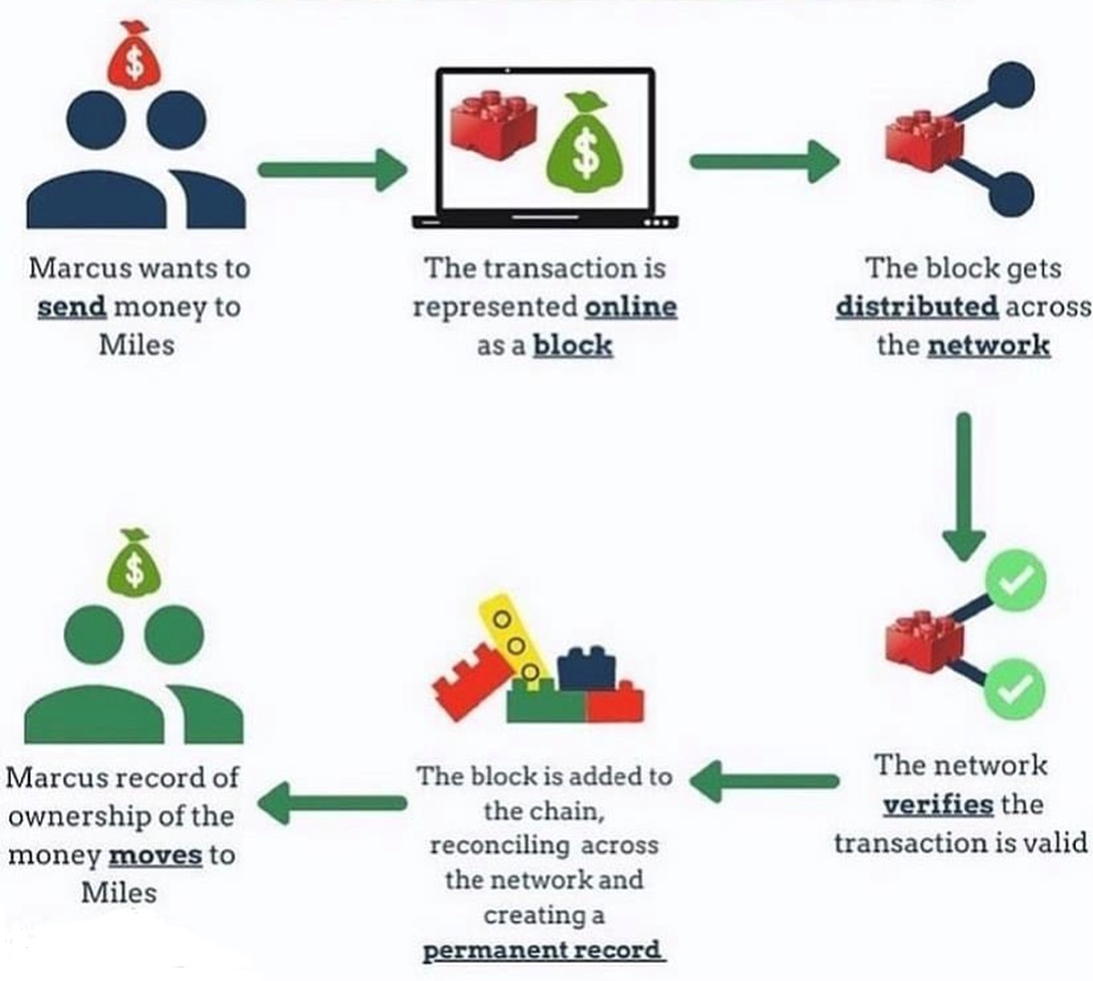

Staking is a great way to earn passive income with low effort. Simply put, staking is locking your coins up in a cryptocurrency wallet for a certain amount of time, so you can participate in maintaining the operations on a blockchain. To elaborate and explain conceptually, you are lending your coins to support a blockchain network, by validating a block within a network to confirm transactions. In exchange for lending your coins and helping safeguard the network through validating a block on the blockchain, the network rewards you with coins. Blockchains choose participants at random, raise them to validators, and then reward them for their work. This method is fairly simple, and requires little work. To get started, you set up a staking wallet and then your staked coins are frozen for a period of time, and then used to validate transactions on a block. In exchange for “freezing” your coins for a period of time, you receive a percentage of the staked tokens as a reward. Staking is only available with cryptocurrencies that use the proof-of-stake model to process payments. Among the most popular PoS blockchains are Ethereum 2.0, Cardano, Polkadot and Solana. Some popular platforms to stake on are Blockfi, Coinbase, Binance, Kucoin, FTX, Pancake Swap and Uniswap.

Crypto Yield Farming

Yield farming allows you to earn passive income by becoming a liquidity provider, where you essentially deposit coins into trading pools, and as a reward for providing liquidity for other traders to execute a trade, you are rewarded with trading fees. To use this method, you provide two different coins to a liquidity pool in order to provide liquidity which allows traders to trade a pair of coins. You then earn a portion of the trading fees from trading the coin pair. To minimize risk with this method, you should only use exchanges that hold well-established pools and farms with a history of stability. The most popular DeFi exchange to yield farm are Uniswap, Aave or PancakeSwap.

Crypto Mining

Most simply explained, mining is required to keep the blockchain working. To elaborate, mining secures the network by verifying cryptocurrency transactions so that they can be added to the blockchain, and you receive a reward for assisting in this process. To use this method, you would need a mining rig. A mining rig is a computer that is built for mining cryptocurrency. What differentiates a mining rig from a simple laptop, is that a mining rig has multiple Graphic Processing Units (GPUs) connected to the motherboard. After you have a mining rig, you can connect to mining pools which run the complex algorithms, which solve complex mathematical problems with cryptographic hash functions that are associated with a block containing the transaction data. This process ensures the authenticity of information, and then updates the blockchain with the transaction. This is the process to mine cryptocurrency whenever a cryptocurrency transaction is made.

Mining can be very profitable depending on the type of crypto currency that is mined, but also be aware of costs for the hardware and software to do so. Additionally worth noting, crypto mining can consume a significant amount of electricity depending on the type of GPU used.

Opportunities & Risks

I am grateful that I have been able to make consistent passive income with cryptocurrency over the years. The passive income opportunities available through cryptocurrency are be significantly greater than what is offered through traditional banking. I truly believe that cryptocurrencies have the potential to change how we do many things in the future! I also believe Cryptocurrency will continue to grow on both an institutional and retail level. Every month we have more and more billionaires, banks and institutional investors buying crypto, as well as millions of individuals and businesses adapting to the crypto environment every year. However, it is important to note that nothing is without risk. Before investing in crypto, you should educate yourself about the risks and speak with a financial planner to calculate your potential investment in crypto based on your risk tolerance, investing timeline and age. Also educate yourself on the unregulated and volatile nature of the cryptocurrency market. Cryptocurrencies can experience price fluctuations and decrease in value, and there is no guarantee that they will maintain their value in the future. With that in mind, you should not attempt to earn passive income in crypto with money that you cannot afford to lose.

I originally wrote this article for DomainMoney.com.

If you enjoyed this read, feel free to also follow me here on medium or clap/ like this article. Also here is my contact info and social medias:

Twitter (5,000+): https://twitter.com/FluentInFinance

Youtube (3,000): https://www.youtube.com/FluentInFinance?sub_confirmation=1

Facebook Page (2,000+): https://www.facebook.com/FluentInFinance

LinkedIn (15,000): https://www.linkedin.com/in/lokenauth/

Instagram (50,000+): https://instagram.com/Fluent.In.Finance

TikTok (50,000): https://www.tiktok.com/@fluentinfinance

Reddit Community (40,000+): https://www.reddit.com/r/FluentInFinance/

Discord Group (5,000): https://discord.gg/BEapnwWHGy

Facebook Group (5,000): https://www.facebook.com/groups/financetalk

#Crypto #Cryptocurrency #Bitcoin #Ethereum #Blockchain #PassiveIncome #CryptoMining

Andrew Lokenauth is a finance executive, personal finance expert and founder of Fluent in Finance, who leverages his education and professional experience to provide insights around personal finance and investing, in order to help others build wealth and retire early. Andrew graduated with a degree in Accounting & Finance from Pace University, and started his career at Goldman Sachs. Andrew is currently at a fin-tech start up as the VP, Director of Finance & Accounting, and prior, he was at Amalgamated Bank as Vice President, Head of Financial Reporting & Accounting Policy. Andrew is passionate about providing financial education in an accessible and easy-to-understand way, helping others build wealth and retire early. He founded Fluent in Finance to provide resources on helping others learn financial planning, building wealth, understanding the importance of investing, creating a healthy budget, strategizing debt pay-off, developing a retirement roadmap and creating an investing plan. He has been featured in Forbes, Business Insider, Yahoo Finance and U.S. News multiple times.

Join Coinmonks Telegram Channel and Youtube Channel learn about crypto trading and investing